Luxembourg: A Gateway for Alternative Investment Funds

Luxembourg: A Gateway for Alternative Investment Funds

Article by Luxembourg Times from 29.09.2025

Luxembourg has long established itself as Europe’s premier hub for investment funds. Today, alternative investment funds (AIFs) are shaping the next chapter of its financial center, offering global investors a unique blend of stability, innovation, and opportunity - yet not without regulatory challenges.

The Rise of Alternative Investments

Over the past few years, the global investment landscape has shifted dramatically. Traditional asset classes such as equities and bonds, while still essential, no longer provide the diversification and yield that sophisticated investors demand. Against this backdrop, alternative investment funds (AIFs) have emerged as powerful vehicles for portfolio optimization.

Private equity, real estate, private debt, infrastructure, and hedge funds are no longer niche products reserved for a select few; they are now part of mainstream asset allocation strategies for institutional investors, pension funds, and high-net-worth individuals. These investors are drawn to alternatives not only for their potential to generate enhanced returns but also for their ability to mitigate volatility and provide exposure to real assets and innovative sectors.

Luxembourg, with its sophisticated financial ecosystem, global reputation, and adaptable legal framework, has naturally become a preferred jurisdiction for these vehicles. Its success rests on a delicate balance: offering a secure, transparent environment while remaining flexible enough to accommodate innovation and the evolving demands of global capital.

Why Luxembourg?

Luxembourg’s position as a global leader in alternative investment funds is built on a combination of strong regulation, structural innovation, international reach, and tax neutrality. Together, these elements form an ecosystem that continues to attract fund sponsors and investors from all over the world.A Stable and Reputable Legal and Regulatory Environment

Luxembourg has become synonymous with regulatory reliability. The country was among the first to transpose the Alternative Investment Fund Managers Directive (AIFMD), ensuring compliance with European rules while maintaining a pragmatic supervisory culture. The AIFMD passport enables managers domiciled in Luxembourg to distribute their funds seamlessly across the EU, giving them immediate access to one of the world’s largest investor markets. This combination of rigour and accessibility has made Luxembourg a trusted springboard for global strategies.

A Wide Range and Flexible Fund Structures

The Grand Duchy offers one of the most complete and versatile toolkits for fund structuring in the world. Vehicles such as the Reserved Alternative Investment Fund (RAIF) allow for rapid time-to-market, while the Specialised Investment Fund (SIF) and SICAR (Investment Company in Risk Capital) provide tailored solutions for institutional investors and private equity managers. In parallel, unregulated partnerships such as the SCSp (Special Limited Partnership) replicate common law models, offering international sponsors familiarity combined with European advantages. This diversity ensures that managers can set up structures perfectly aligned with investor expectations and investment strategies.

Global Connectivity

Luxembourg is not only a jurisdiction but also a cosmopolitan hub for financial expertise. Its workforce is multilingual and multicultural, with professionals from more than 100 countries supporting the entire fund lifecycle. Law firms, administrators, depositaries, auditors, and tax advisers have developed deep expertise in cross-border investment, ensuring efficiency and precision in structuring even the most complex transactions. Strategically located at the heart of Europe and supported by strong political and economic stability, Luxembourg serves as a bridge between global capital and European opportunities.

Tax Neutrality, Compliance and Transparency

Although tax neutrality alone is not sufficient to explain Luxembourg’s position in the alternative investment fund industry, it is a necessary, but not a stand-alone, condition. This tax neutrality principle ensures that funds are not subject to an additional layer of taxation at the fund level, avoiding double taxation and allowing investors to be taxed in their own jurisdiction.

Equally important is Luxembourg’s proactive and consistent approach to regulatory and fiscal alignment. The country has consistently adapted its legislation to international highest standards, swiftly transposing European and OECD rules – such as the ATAD Directives and BEPS initiative – while ensuring full compliance with international transparency requirements. This ability to combine compliance with tax neutrality has been instrumental in reinforcing investor confidence and maintaining Luxembourg’s leadership in the alternative funds space.

Furthermore, Luxembourg is committed to ensuring that all stakeholders in the alternative investment fund industry – from investors and sponsors to asset managers – work in close cooperation and remain firmly established in the country. In addition to ensuring a stable and compliant framework, Luxembourg is also constantly updating its tax environment in that respect. A recent example is the (much awaited) draft law aiming to amend the Luxembourg carried interest regime, designed to align the interests of fund managers with investors and sponsors. Such initiatives underline the Grand Duchy’s commitment to combining international market competitiveness with credibility and consistency.

Regulatory Constraints: The Other Side of the Coin

Luxembourg’s fund industry is admired for its sophistication and credibility, but that reputation comes with a price. The very strength of its ecosystem - its robust and forward-looking regulatory framework - also creates complex and resource-intensive obligations for managers. These requirements demand constant vigilance, well-structured compliance teams, and significant investment in systems and expertise.

While these obligations can indeed be demanding, they are not imposed in a vacuum. Luxembourg’s regulatory environment is the result of continuous and constructive dialogue between market practitioners and the Luxembourg legislator. Professional associations such as ALFI and LPEA play a key role in this exchange, ensuring that the framework remains both rigorous and pragmatic. This collaborative approach helps to shape rules that safeguard investors and preserve market integrity, while also taking into account the operational realities of fund stakeholders.

AIFMD: More Than Just a Passport

While the Alternative Investment Fund Managers Directive (AIFMD) provides the crucial EU passport for marketing funds across the European Union, compliance is anything but light-touch. Luxembourg-based managers must implement comprehensive risk and liquidity management frameworks, often requiring scenario analysis and stress-testing. They must also submit detailed Annex IV reports to regulators, covering exposures, leverage, and systemic risk metrics. Furthermore, managers are expected to maintain sufficient capital and genuine substance in Luxembourg - meaning real decision-making must take place locally, supported by qualified staff and infrastructure. This ensures credibility, but for smaller or newer managers, it can represent a steep barrier to entry.

SFDR and ESG Commitments

The Sustainable Finance Disclosure Regulation (SFDR) has transformed ESG from a marketing buzzword into a compliance obligation. Luxembourg managers must now classify their funds as Article 6 (non-ESG), Article 8 (promoting ESG characteristics), or Article 9 (sustainable objective funds). Choosing Articles 8 or 9 can enhance marketability - especially with European institutional investors - but also requires a high degree of data collection, monitoring, and verification. This often means integrating ESG considerations into every stage of the investment process, from due diligence to reporting, while ensuring that disclosures remain accurate and up to date. For private equity or real estate funds, this can involve tracking carbon footprints, supply-chain impacts, or social governance metrics that were not previously in scope.

AML and KYC: A Culture of Vigilance

Luxembourg applies one of the most rigorous Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regimes in Europe. Managers must conduct in-depth onboarding checks on investors, identify ultimate beneficial owners (UBOs), and maintain ongoing monitoring of transactions. This not only protects the reputation of Luxembourg as a clean and secure financial centre, but also requires managers to build robust compliance infrastructures - often supported by regtech solutions. The burden is particularly heavy for managers raising capital from diverse investor bases across jurisdictions, where documentation standards vary.

Taken together, these obligations may appear burdensome, but they also form the backbone of Luxembourg’s competitive advantage: investors know that funds domiciled in the Grand Duchy operate within a framework of high standards, rigorous oversight, and long-term credibility.

Innovation Meets Stability

Despite these heavy regulatory demands, Luxembourg has proven itself remarkably agile in combining innovation with predictability. The Grand Duchy has embraced digitalisation, encouraging the use of fintech solutions for fund administration, reporting automation, and AML/KYC monitoring. This reduces costs while increasing accuracy.

Equally, Luxembourg has positioned itself as a global leader in sustainable finance. It was the first country to launch a dedicated green exchange, and today it is a reference point for ESG-driven strategies. These initiatives resonate strongly with investors seeking not only financial returns but also alignment with sustainability objectives.

At the same time, the country’s AAA credit rating, political stability, and prudent fiscal management provide a reassuring backdrop for long-term investment. In an era where geopolitical tensions and market volatility are the norm, Luxembourg offers something increasingly rare: consistency.

Looking Ahead

The future will bring more regulation, not less. The implementation of AIFMD II, the expansion of ESG disclosure frameworks and the constant evolution of the European and international tax rules will further shape the operating environment. Managers who succeed in Luxembourg will be those who can balance opportunity with compliance - leveraging the jurisdiction’s strengths while building the operational resilience needed to thrive under growing scrutiny.

Ultimately, Luxembourg embodies both the opportunities and responsibilities  of modern fund management. It demonstrates that high governance standards, strong investor protection, and tax transparency are not constraints but necessary conditions for positioning Luxembourg as a prime location for alternative investment funds. In a world where alternatives are becoming mainstream, Luxembourg continues to stand as a benchmark of excellence, resilience, and trust in the global fund industry.

of modern fund management. It demonstrates that high governance standards, strong investor protection, and tax transparency are not constraints but necessary conditions for positioning Luxembourg as a prime location for alternative investment funds. In a world where alternatives are becoming mainstream, Luxembourg continues to stand as a benchmark of excellence, resilience, and trust in the global fund industry.

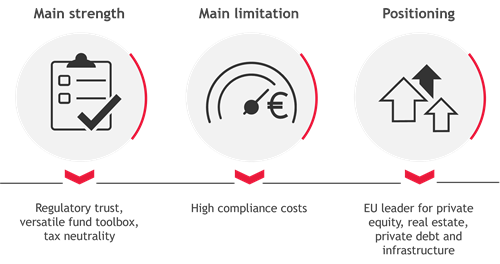

In a nutshell: Luxembourg dominates the European alternative investment space.

Luxembourg nevertheless retains a very strong reputation thanks to its wide range of vehicles, flexibility, regulatory innovation, and well-developed ecosystem. This gives the Grand Duchy an advantage in many segments, particularly in more complex alternative funds or those requiring highly tailored structures or advanced partnership arrangements.